As we move into today’s fast-paced digital world, the ongoing usage of cash is starting to decline, although Commbank has decided to play its role in providing its customers access to physical currency. Over the years as changes have been made to the automatic withdrawal of money such as providing cardless options for ATMs it is essential for Commbank to still manage its cash services as well as customer performance, fees and economic impacts to everyday banking.

Commonwealth Bank shares dropped by eight per cent last week, a decline which was caused due to the release of a disappointing quarterly update from National Australia Bank Ltd.( ASX: NAB). The drop in shares thankfully bounced back, rising 2.97% on Monday.

Amid, speculation behind CBA removing cash for good, CEO Matt Comyn shuts down the news as he emphasises in a letter that physical cash is “here to stay”. He further noted, “While your banking preferences may continue to change, we know that cash remains critical to our customers, the community, and to CommBank – and it’s here to stay.”

Commyn also committed to extending the period of keeping all regional branches open until at least the 31st of July 2027, to support local communities and regional jobs in Australia as CBA continues to recognise the unique contribution that the regional sectors of Australia add to our country.

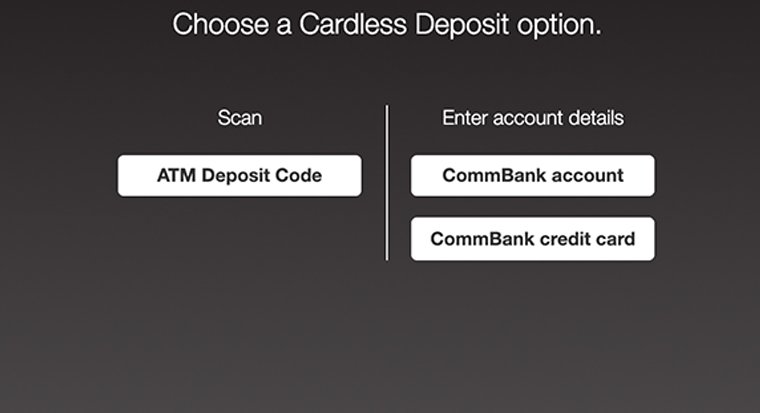

The following image showcases the options that current options commbank ATMs provide. Such options have seen an increase in the way customers have been depositing as well as withdrawing money from their accounts. Some customers are worried about the rise in technology and the utmost takeover, which will eventually be forced to remove the use of cash as new generations come about.

For now, CEO Commyn also stated in his correspondence that as a Bank, “We’ll continue to distribute more than $4 billion in cash each month through Australia’s largest branch and ATM network, which will also benefit from $100 million in upgrades in 2025”. Upgrades regarding the branches and ATM fleet for multiple ATMs ensure they are functional, stocked with cash, and secure despite the overall decline across all banks in the number of ATM’s across the country.

Since, Cash is “here to stay”, the dramatised $3 withdrawal and deposit fee within ATM CommBanks is set to be cancelled after receiving heavy backlash from both customers and the government, Commwealth Bank has therefore as mentioned, reversed its decision to introduce the astonishing $3 fee for assisted cash withdrawals.

What does the future of Cash look Like? as scammers arise more money has been going into the prevention of them causing more problems and maybe making it conclude that cash should be here to stay as it is more reliable than our credit cards and bank accounts nowadays.

Written By: Eva Pocrnja

Published: 26th of February