In the conservative world of Australian wealth management, results are usually whispered in private boardrooms and glossy quarterly updates. But on 6 January 2014, Michael Kodari flipped the script—he went public. Sharing a live model portfolio on national television, he invited scrutiny, not hiding behind jargon or disclaimers. That transparency was the foundational act of a mature strategy that would reshape investor trust and boutique wealth credibility.

The Bold Experiment

Kodari presented a six-stock, live-tracked model portfolio on the Sky Business Channel. This wasn’t just slick marketing—it was a live experiment in accountability:

- Monthly disclosure of holdings and prices

- Reactive adjustments based on market signals

- Real-time tracking, visible to peers and clients nationwide

By laying his strategy bare, Kodari invited direct comparison against market indices—and he didn’t just match expectations; he obliterated them.

The Staggering Outcome

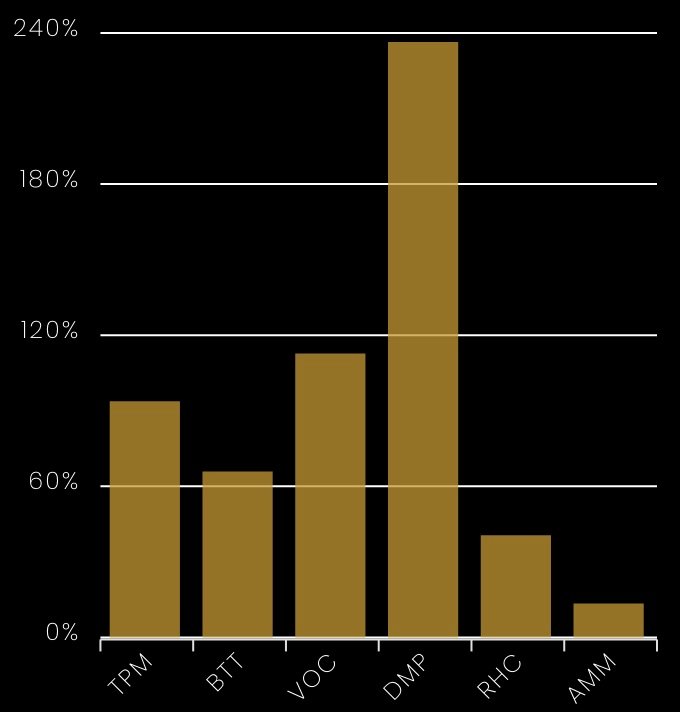

Eighty-five days later, on 17 March 2014, the portfolio delivered an astounding 93.81% return, nearly doubling in less than three months. To put that in perspective, during the same period, the All Ords/index returned −1.90%, and the ASX 200 −2.94%. This meant:

- A 95.7% outperformance over the ASX benchmark

- Five of six stocks surpassed 65% returns: one rocketed +236%

- A triumph during a period when peers floundered

This wasn’t luck—it was evidence. A public demonstration that disciplined, model-based wealth management could beat emotionally driven markets, even in sideways or falling conditions.

Shaking the Boutique Wealth Stereotype

Up to that point, “boutique” often suggested limitations—smaller research capacity, reduced access to institutional-grade tools, or a reliance on charisma over method. Kodari shattered those preconceptions. The 2014 portfolio was more than just a high-return case study; it was proof that disciplined methodology, rigorous research, and technological support could rival and even outpace the performance of larger firms.

KOSEC, under Kodari’s direction, presented an alternate vision for boutique wealth management. It didn’t need the scale of a global bank to deliver sophisticated outcomes. What it needed—and had—was conviction in process, a deep respect for data, and the courage to be judged publicly on performance.

A Lasting Impression

Michael Kodari’s 2014 portfolio wasn’t just a financial win but a reputational breakthrough. It exemplified the power of transparency, the credibility of research-led investing, and the strength of conviction in process over marketing.

It didn’t just elevate KOSEC—it raised the standard for the entire industry. And in doing so, it offered investors something they rarely get: proof.

Written by: Christine Daoud

Published on: 23rd June 2025